Based on your (visual) findings, clearly state if PPP captures the short-run and/or long-run behavior of S t.

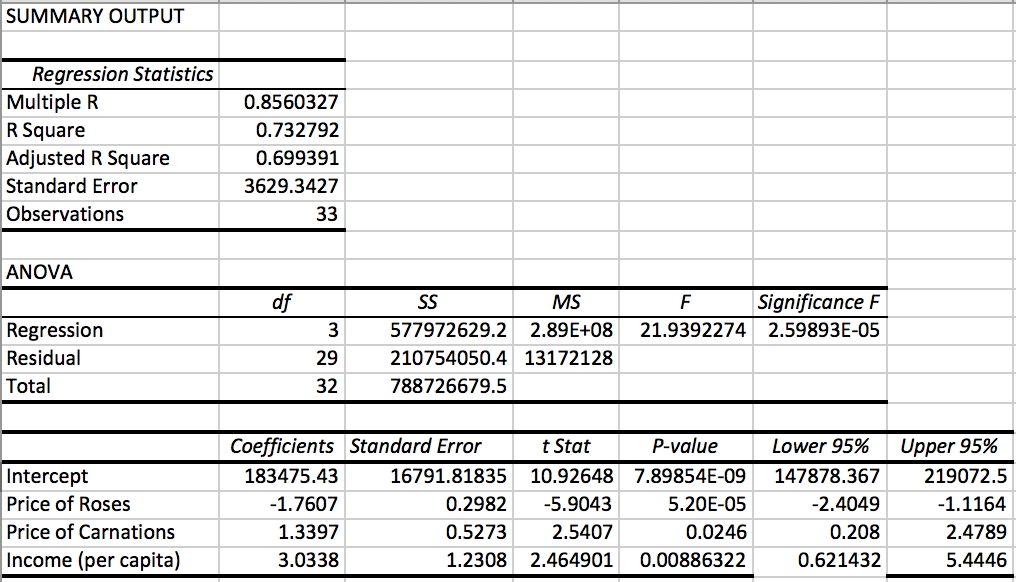

(The period from January 2016 till the End of your sample is your validation sample.) Get estimated coefficients.Ģ) Using the estimated coefficients and the lagged inflation rate differentials at time t+i, forecast S t+i, for i=Januray 2016, End of sample.ģ) Calculate the out-of-sample MSE, and compare it with the RW's MSE.Įstimation Period: From the start of your sample to December 2015. Also, report the MSE for the PPP-based regression model.ġ) Using the estimation period (a reduced sample) from start of your sample to December 2015, run a regression. Null hypothesis to test: α=0 and β=1.ī.2 Compare PPP's MSE with a RW's MSE (MSE=Mean Square Error). (Force R t to start with S t).ī.1 Using the whole sample, run a linear regression. Graph PPP exchange rates along S t.Ī.3 Determine the Real FX rate. Check if the plot forms a 45 degree line -i.e., the PPP line.Ī.2 Determine PPP exchange rates. That is, you need to create e f,t, I FC,t, and I DC,t.Ī.1 Plot e f,t against (I DC,t - I FC,t). Thus, you need to put the data into percentage changes to test relative PPP.

#Excel linear regression alpha download

Download PPP data set (Excel format)ĬPI and Exchange Rates are in levels. Malaysia, Canada, Mexico, USA, Egypt, South Africa and Australia. The countries are UK, Switzerland, Denmark, Norway, India, Japan, Korea, Thailand, Singapore, You have monthly Consumer Price Indexes (CPI) and exchange rates (S t) from January 1971 till now for 15 countries (For some countries, the starting date is later.) To get forecasts for inflation rates -i.e., E t - E t-, assume the Random Walk model for inflation rates. To get E t, you'll use the linearized Relative PPP based model:Į t = α + β (E t - E t). Under Relative PPP, the hypothesis to test is: H 0: α=0 and β=1. You'll test Relative PPP using a regression based on the Relative PPP model: You'll use the linearized Relative PPP model: e f,t = (I DC,t - I FC,t). (As long as trade frictions are unchanged). The rate of change in (index) prices should be similar when measured in a common currency. If you do not do the assignment using your assigned currency, you'll receive zero credit.)

(You are assinged a currency according to your student number.

You will forecast that exchange rate using PPP. You will test the PPP Theory for one currency. Researh Project: PPP - Testing and Forecating (Due: ONE WEEK AFTER FIRST MIDTERM)

0 kommentar(er)

0 kommentar(er)